Today, WEMULCH.COM, the modern land clearing management platform, announced results from its 2022 Annual Land Clearing Business Survey. Focusing on small- to mid-size business owners in land clearing and forestry. In its first year, the initial baseline was set to identify business opportunities and challenges, drawing a consistent track record for future years to come and forecast possible trends within the land clearing industry, which mainly consists of small- to midsize companies.

In November 2022, WEMULCH launched the first-ever nationwide assessment for small to mid-size land clearing businesses in the USA. And with the provision of transparent feedback on market situation, business challenges, sentiments, job specifications, company structures, and equipment we want to enable service professionals to benchmark their business with their land clearing peers.

We looked primarily at key performance indicators of the business, work radius, sentiments, business challenges and equipment used.

Smaller businesses often find themselves without support because they don’t have the resources investing into marketing or networking activities. With the Annual Land Clearing Business Survey, WEMULCH set a framework to understand and help those small to mid-size businesses to grow. Therefore, the confirmed need for local lead generation in combination with the stated main challenge of getting jobs will unquestionably shape future services of WEMULCH.

The final report of the ALCS 2022 can be downloaded at: www.survey.wemulch.com

KEY CONCLUSIONS

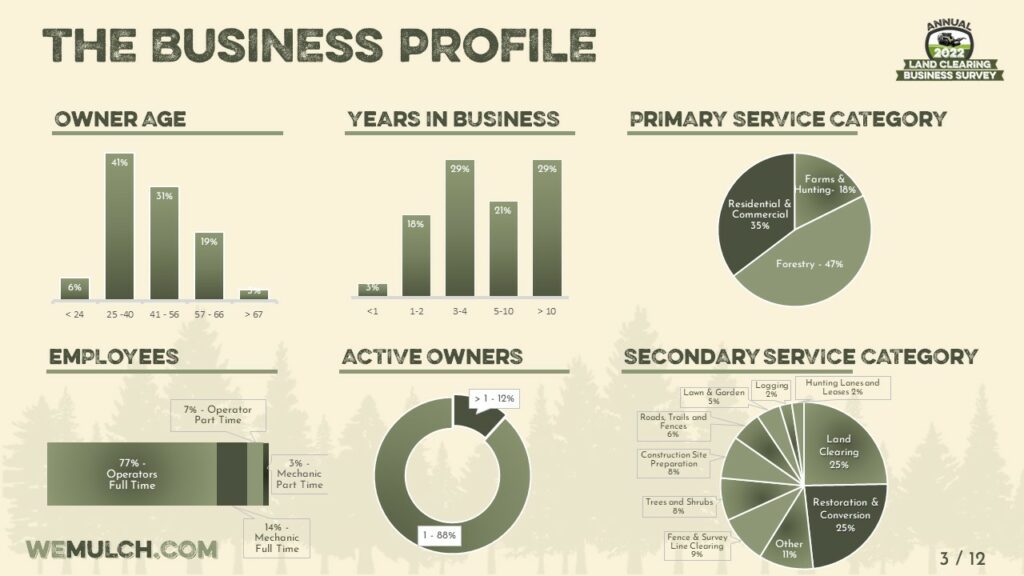

- Most land clearing businesses are already well established and passed the critical 3-year mark.

- The primary service category is Forestry and secondary services are Land Clearing, followed by Restoration & Conversion services.

- Most businesses operate in a 100 to 150 mile radius with a maximum job size of 20 acre and a minimum job size as low as 1 acres

- Hiring new people is expected to become substantially worse whereas the companies profitability seems to rise within the next 3 months.

- Most professionals rely on their own experience for pricing jobs and often ask friends or other partners for their advice.

- Getting jobs is seen as the main challenge but getting paid for the jobs seems the least challenge.

- Uncertain economic conditions and inflation are seen as the biggest threads from the outside.

- Most businesses operate with a skid-steer from Caterpillar and a forestry drum mulching attachment from FAE. And only 16% are currently using a disc mulching attachment.

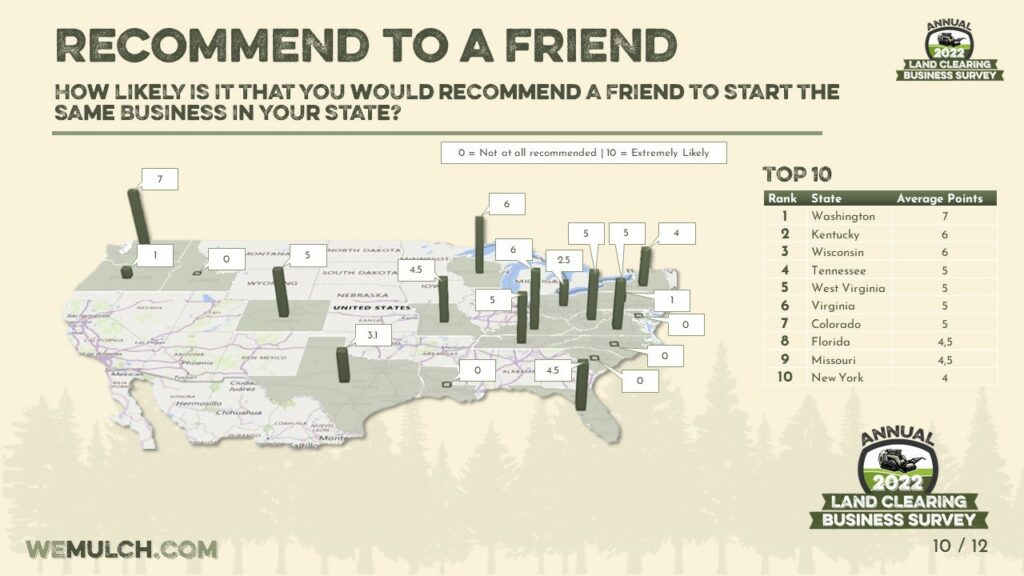

In addition to the key conclusions of the survey, professionals could rate if they would recommend a friend to start the same business in their state. The TOP three positions are Washington State with 7 out of 10 points, followed Kentucky and Wisconsin:

TOP 10 machine types shows that tracked skid-steer machines are the TOP choice for professionals, followed by chippers and mulching heads at excavators.

| Rank | Machine Type |

|---|---|

| 1 | Mulcher – Skid Steer |

| 2 | Chipper |

| 3 | Mulcher – Excavator |

| 4 | Wood Chipper – Towable |

| 5 | Stump Grinder – Tracked |

| 6 | Mulcher – Dedicated carrier |

| 7 | Trimmer |

| 8 | Lawn mower – Riding |

| 9 | Horizontal Grinder |

| 10 | Log Splitter |

Looking at the tracked skid-steer machine brands, CATERPILLAR is leading the pack.

With 84% forestry drum mulchers are leading the field versus 16% running with disc mulchers.

| Rank | Brand |

|---|---|

| 1 | FAE |

| 2 | FECON |

| 3 | Loftness |

| 4 | Denis Cimaf |

| 5 | Tigercat |

| 6 | Prinoth |

| 7 | Diamond Mowers |

| 8 | Bradco |

| 9 | ShearEx |

| 10 | Other |

Image Courtesy of Siefring Skid Steer Services

Image Courtesy of Siefring Skid Steer Services